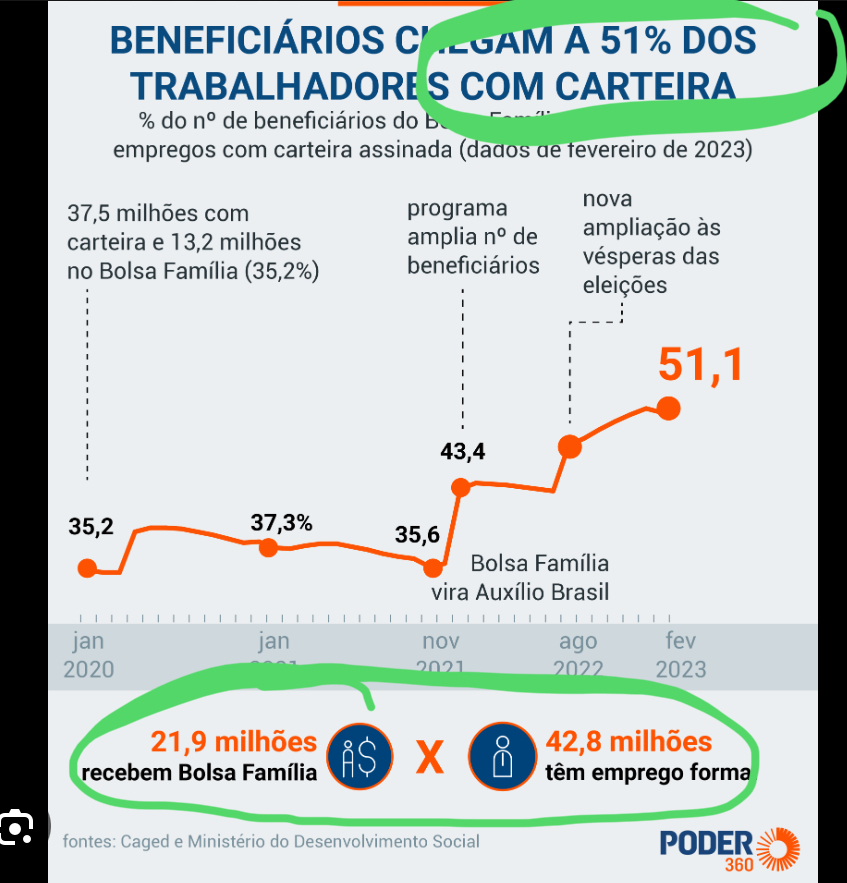

Basileia obriga Bancos a emprestarem até 12 x o seu capital corroído e não corrigido pela inflação. Um tiro no pé.

The American Banking System is one of the most regulated industries in America.

Since 1935 banks have had to deal with regulations that no other industry has come near by.

Due to these Banking Regulations set up as early as 1935, banks have over the years lost interest in lending per se, and have been forced to enter all other types of financial markets, such as derivative service fees, equity deals anything but straight plain-vanilla loans.

As a consequence banks have also lost interest in credit analysis, and America as a nation has lost its credit intelligence, whose effects can be seen today.

Credit intelligence can be found in only two or three companies such as Moody’s, Fitch and Standard & and Poor’s, and even that is contested today.

In the 70’s courses like Management of Lending, such as those given by Charlie Williams of Harvard Business School were oversubscribed. Today such course no longer exists at Harvard.

Credit training was once considered an important step in a young man’s career, so much so that four Presidents of the United States started out as trainees at Dunn & Bradstreet, Lincoln, Grant, Cleveland and McKinley.

They learnt the Five C’s of credit analysis formula: Character, Conditions, Cash Flow, Capacity and Collateral – which became a subtle art. Today credit is given by quantitative formulas, based on one single variable Collateral.

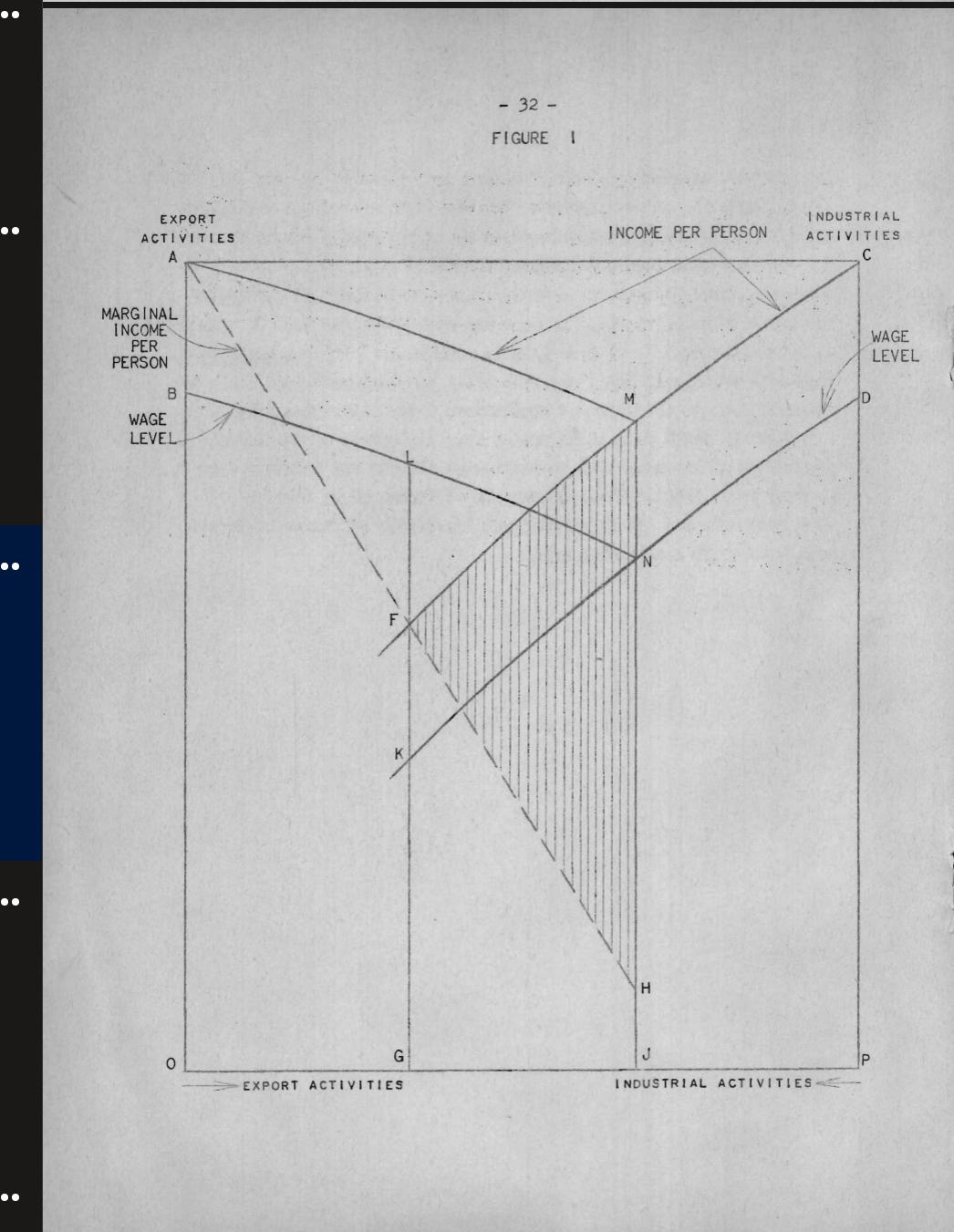

Because of the banking bankrupcies due to the 1929 crash, banking regulations were devised setting up minimal capital requirements. They established capital adequacy ratios in order to prohibit banks from lending more than four to 12 times their capital plus retained earnings.

The latest versions of these capital adequacy ratios are now worldwide, embedded in the Basel I and Basel 2 agreements.

But the bank regulators of that time, did a poor regulating job, by creating rules that would not stand up the test of time.

There is a flagrant mistake in this rule, which would slowly destroy world banking lending capacity over the next seventy years.

Regulators did not take into account future inflation.

An inflation that over the next seventy years would slowly erode the capital base on which the banking systems rest. A 4% inflation rate multiplied by 12 reduces banks lending capacity by 48% of their capital base. In a single year!

Basically what regulators did, was to establish lending limits tied to the following ludicrous and dysfunctional banking rule.

Banks ought to be limited in their lending to 12 times their inflation-eroded capital.

In years of especially high inflation, banks were required to recall many of the loans outstanding in order to comply with this ludicrous banking regulation.

In years of low high inflation, retained earnings would allow them to maintain their current loans outstanding and even increase them, but always losing market share.

With today’s capital base worldwide at around $200 billion, factor in a 4% inflation multiplied by 12, and you will discover that banks worldwide will be constrained to reduce loans outstanding to the order of $2 trillion in 2009 and 2010.

That will be on top of the estimated $200 billion write-offs, which will also be multiplied by 12, reducing loans outstanding an additional $2 trillion in order to comply with bank regulations.

Now answer this question: was this crisis caused by corporate greed and management bonuses, or by faulty legislation?

Are we in the face of a credit crunch, illiquidity, or is there a regulation forcing banks to withhold credit?

It is frightening to realise that academics such as Milton Friedman, John Maynard Keynes and John Kenneth Galbraith all of who wrote extensively about 1929 and banking regulation, should have overlooked such a simple regulatory mistake with such an impact on banks lending ability.

Which also applies to subsequent Nobel Prize winners, any one of which would never agree to tax brackets not adjusted to inflation from time to time.

Unfortunately, none of them are versed in accounting, in countries where inflation was double digit.

Granted that inflation rates were low, and retained earnings of banks were high at the time, banks were allowed to grow though not at full speed. But in 1982 when inflation in the United States reached 20% over a two-year period the effects were devastating.

Every single American bank had to recall practically 200% of their capital base, mainly from underdeveloped countries setting off one of those graders financial crises in the Third World.

Instead of changing banking regulations and allowing banks to adjust their capital bases to inflation, most economists once again blamed the Banks, as in 1929, accusing them of having overextended themselves once again.

More bank regulations were called for, instead of correcting what must have been the most ridiculous and incoherent rule in economic history.

Forcing banks to erode their accounting capital base rather than reflecting the effects of inflation has slowly and inexorably destroyed the worlds’ banks lending capacity year after year. Instead of a world debt crisis and IMF bailouts with stringent and recessionary economic policies for over indebted countries, had banks been allowed at that time to lend their inflation adjusted capital, they would have solved the debt problems on their own.

Not only were they prohibited from lending to Third World countries in order to maintain their debt level in real terms, banks were also forced to make bad debt provisions depleting even more their lending base.

Once again banks are required to make provisions and write-offs for having lent to poor people compounding once again the current financial crisis.

Just as we are doing today, economists in 1986 demanded even more stringent bank regulations, which became the Basel I and Basel II agreements. Rather than adjusting capital base to inflation, banks were compelled by these agreements to calculate risk-adjusted capital base eroded every year by the current rate of inflation.

Capital adequacy rules were originally designed to strengthen banks, but oddly enough, leading economists have totally failed to see that they have slowly and inexorably destroyed banking and lending capacity each year.

No wonder that banks have lost interest in credit analysis and prefer all sorts of off-balance sheet derivatives.

Constrained by government, banks found various ways to circumvent these operational limitations.

Banks threw away their five C’s of credit measurement, foregoing the analysis of Character, for example. Banks closed down their credit departments and slowly shifted from being a lending institution to becoming wholesalers of financial derivatives and asset-backed securities.

Credit departments were slowly replaced by complicated economic models which, only now Alan Greenspan realizes were based on insufficient quantitative data. But he misses the point: there will never be sufficient data to be able to substitute the individualized scrutiny of a credit committee.

Banks have slowly lost their lending capacity to “financiers” like Mike Milken, whose far from being financial whizzes, were the beneficiaries of a banking regulations that allowed them a field day.

Constrained as a lending institution, the deterioration of our banking system gave rise to an equity-based economy. Companies were not allowed anymore to leverage, and had to depend on volatile and expensive equity market.

This effectively crowded out small and medium companies from cheap financing, and paved the way for the big globalized corporations that have the power nowadays, producing in India and China to reduce costs.

We have slowly destroyed our credit intelligence, substituting it for credit ratings issued by three relatively small companies, which clearly are overwhelmed and are not prepared to do the job they have been forced to do.

None of the measures to correct this financial crisis has addressed the fact that the capital adequacy ratios and the accounting data are totally incorrect.

The consolidated net equity of the banking system has been totally eroded by seventy years of US inflation, giving the impression that banks do not have enough capital to meet their credit demands.

Bear Stearns was sold for $200 million, and no one realized that only it´s central office building alone is worth more than $1.5 billion, but due to inflation this current value does not appear in it´s books.

What we see is another blame it on the banks movement, which will only destroy even more our banking system; will deplete even more our credit intelligence; will reduce even more the ability of small and medium companies in securing cheap loans supervised by a competent and experienced credit committee within full-fledged banking institutions, making loans the old fashioned way.

One Response

Macroeconomists are not versed in accounting praxis! Concerning the current banking system main actors are always on the job training!